Financial Reporting Series: Automate Your Cash Flow Statement in PowerBI for Real-Time Insights

- Abdulazeez Abdullah Temitope

- Feb 28, 2025

- 3 min read

Updated: Aug 11, 2025

Staying on top of your organization’s financial health is more important than ever. Financial statements like the income statement, balance sheet, and cash flow statement are essential tools for understanding how money flows in and out of your business. However, creating these reports manually can be time-consuming and prone to errors. That’s where automation comes in! By using tools like Power BI, you can streamline the process, save time, and gain real-time insights into your finances. In this article, we’ll walk through how to automate the creation of a cash flow statement in Power BI, even if you’re not an accounting or finance expert. Let’s dive in!

If you’ve ever felt overwhelmed by the complexity of financial reporting, you’re not alone. But what if I told you that tools like Power BI can make this process easier, faster, and more accurate? In this guide, we’ll focus on automating the cash flow statement—a critical report that shows how cash moves in and out of your business. The best part? You don’t need to be a finance expert to follow along!

The Data Model

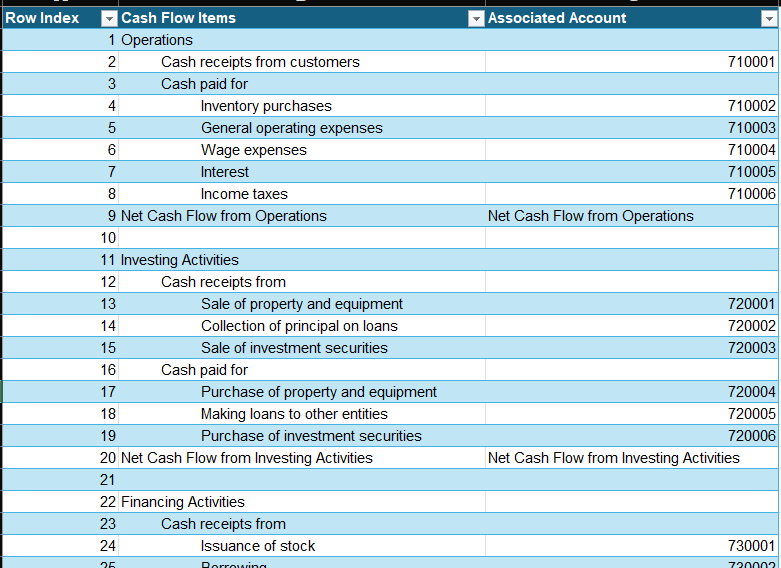

You're in luck if you’ve already created income statements and balance sheets in Power BI by following our previous articles! The same data model, which includes your Chart of Accounts and General Ledger Entries, can be used for the cash flow statement. This means you don’t need to start from scratch. That data model acts as the backbone of your financial reports, pulling information from your accounting system into Power BI.

Always remember to load the template into Power BI (in this case, the cashflow statement template). This template will serve as the structure for your report.

The Calculations

Now comes the fun part; creating the DAX measures that will populate your cash flow statement.

These measures include

Ledger Amount: The total amount of cash transactions recorded in your ledger

Net Cash Flow - Operations: Cash generated or used by your day-to-day business activities

Net Cash Flow - Investing Activities: Cash spent on or received from investments, like buying equipment or selling assets.

Net Cash Flow - Financing Activities: Cash from borrowing, repaying loans, or issuing shares

Net increase in cash: The total change in cash over a period.

Cash_at_start_of_year: your cash balance at the beginning of the year.

Cash_at_end_year: your cash balance at the end of the year.

CS Selected Year Actuals

These measures will automatically update as your data changes, giving you real-time insights into your cash flow.

Report Creation

Similar to what was done with the income statement and balance sheet, the cash flow statement can be prepared using either method. One of the biggest advantages of Power BI is that it allows you to have a single report using the same data model. This means that the data is updated, all the reports will automatically reflect the changes. It’s like having all your financial information in one place, working together seamlessly.

Automatic Data Refresh

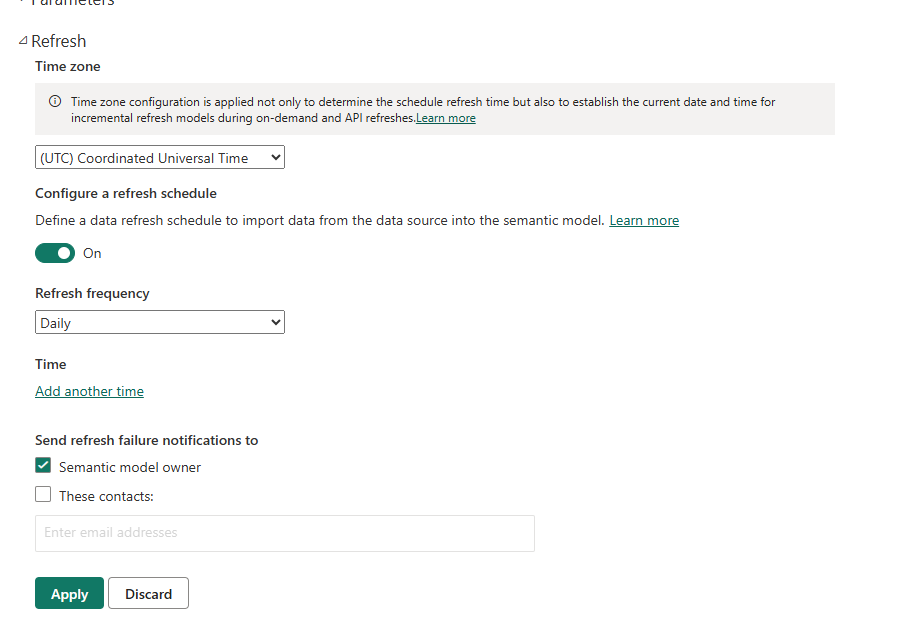

With the P&L, Balance sheet and cash flow in place within Power BI and since all three financial statements reference the same tables (Chart of Account and General Ledger Entries) in our data model, set up your refresh schedule in Power BI service. This ensures that your reports are always up to date with the latest financial data. No more manual updates or repetitive tasks—just accurate, real-time insights at your fingertips.

Automating your cash flow statement in Power BI might sound technical, but it’s a game-changer for your organization. By following these steps, you can save hours of manual work, reduce errors, and gain a clearer understanding of your business’s financial health. Whether you’re a business owner, manager, or just someone curious about finance, Power BI makes it easy to create professional, real-time financial reports. So why not give it a try? With a little effort upfront, you’ll discover a world of efficiency and insight that will benefit your organization for years to come. Happy reporting!

We are your trusted Microsoft Partner for business intelligence, analytics, automation, FP&A, and budgeting. Our expertise in tools like Power BI ensures that your financial reporting processes are streamlined, accurate, and future-ready. Reach out to us today at bifola@tainsighthub.com or abdullah@tainsighthub.com to transform your financial operations and discover the full potential of your data. Let’s build a smarter, more efficient future together.

Comments